Over the weekend, the Fed cut the prime rate to 0.0 – 0.25%.[1] Virtually nothing. Consumers cannot get that rate. Businesses can’t get that rate. It is offered only to the banking industry.

That’s OK. Banks have decades of experience in validating credit risks & making decisions about who to loan money to.[2] Additionally, banks often create & maintain relationships with their corporate & consumer-level customers. One of the tenets of good management is to assign a task to the person with the skill, passion, and ability to accomplish the task. The Congress & the President should consider tasking the Banking industry to help provide financial relief.

We have decided that consumers and businesses could use a shot in the arm during the COVID-related financial crisis. It is clear that many corporations wantonly redistributed their tax windfall two years ago and are unprepared for the significant financial disruption caused by the pandemic. A handout to these companies – or entire industries – often is tied to a raft of rules, regulations, and complex legislative language. To try to do that in a matter of days with any sort of quality is likely impossible.

Two possibilities are most likely in a rushed corporate bailout: (1) Rushed legislation results in unanticipated side effects that are just as dangerous as the problem trying to be solved or (2) industry lobbyists get unrelated concessions harmful to their competitors or American taxpayers.

A more reasonable and achievable option would be to direct banks to make more loans at lower interest rates at record-breaking speed. They can do it. Their people are working from home and need distraction from the neighbor’s dog’s incessant barking. Banks should be directed to invest at all levels of the economy. Banks have special privileges and responsibilities in the U.S. Criteria can be created by Congress and/or regulators to incentivize such a response. With proper oversight, some of which will have to be done in the rear view mirror, direction can be provided to the banks; it would utilize those with the necessary expertise to help alleviate the financial stress.

Obviously, it’s a little more complicated than that. Banks will want risk relief from the government. They shouldn’t get it – they’ll get really cheap money instead and it will be up to them to use it wisely. Banks that do a better job during the pandemic and related financial crisis should get greater benefits and those that fail to do so should not. If the Fed rate weren’t already artificially low, they could get a lower rate. I am sure regulators can come up with both a carrot and a stick to use with banks. Bank regulators have a great deal of experience and talent in that.

Lastly, debt relief needs to be a part of the picture. Credit cards often carry “finance charges” of greater than 20%, all while they are getting virtually free money from the Fed. Reducing the interest rates on those charges and / or providing a finance charge holiday until the end of the crisis would make a big difference to thousands of consumers whose livelihood has been interrupted. Similar actions can be taken on business and consumer loans to help tide them over, as well.

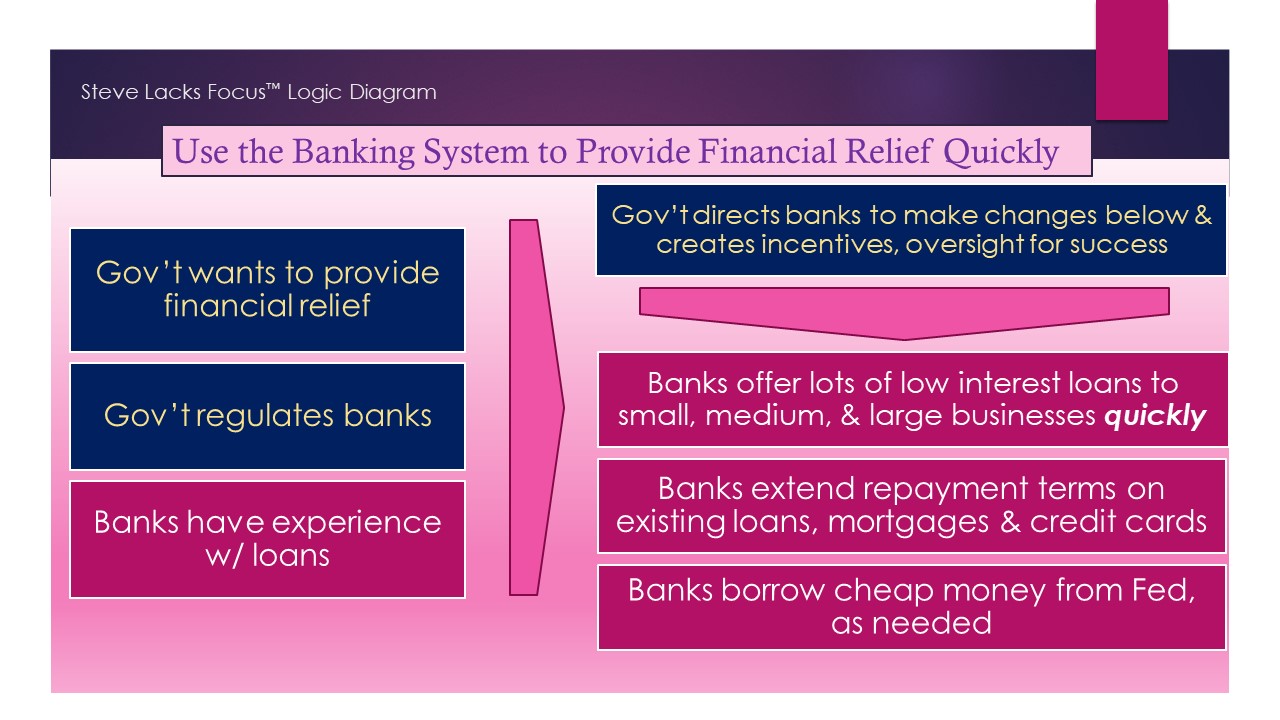

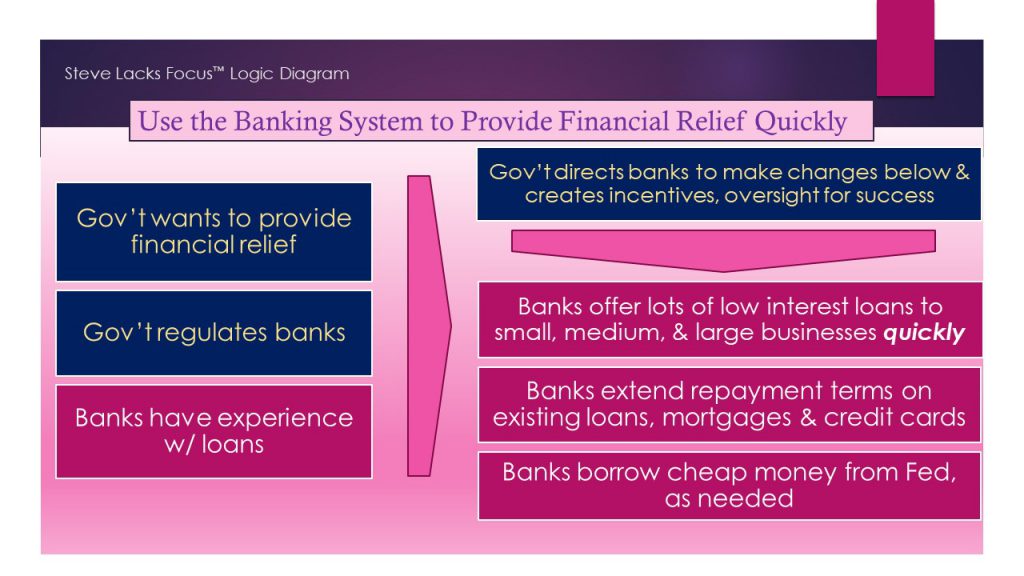

So, here’s the Steve Lacks Focus Logic Diagram:

[1] https://www.usnews.com/news/economy/articles/2020-03-15/federal-reserve-lowers-interest-rate-to-near-zero-as-coronavirus-spreads

[2] I refuse to characterize their decisions as good given the Financial Crisis of 2008 & the Savings & Loan bailout a generation earlier. However, the fact remains that banks have given out trillions of dollars in loans in the meantime and have real experience in this regard that does not exist elsewhere.